Depends on what type of investor you want to be. Profits are made in both scenarios but choosing the right strategy depends on several key factors. Consider your age, need for cash flow, retirement goals and many other factors.

Holding Properties

Buying and holding properties usually are for longer term investments for the purpose of cash flow. In addition to cash flow, the buy and hold investor is also building equity as the mortgage decreases and the home appreciates in value.

Flipping

On the other hand, flipping properties is a short-term investment (at least that’s the initial intent). It is intended to produce capital gains quickly (in theory). There are many risks associated with flipping homes. From underestimating the repair costs, over estimating the market value after repairs, repairs taking longer to complete, property on the market longer than expected, unexpected issues such as structure and a plethora of other potential issues.

HOUSE FLIPPING OR BUY AND HOLD? - Risk and effort go hand in hand when you are thinking of pursuing a career in real estate investment. There are two kinds of incomes that one can generate through real estate marketing. The aggressive cash flow comes from the “fix and flip” kind, where there is a lot of effort and high risk in buying a distressed property, fixing it up and putting it on. Property Flip or Hold - Real Estate Investing CalculationsIncludes online Flip or Hold Calculation website accesshttps://www.udemy.com/property-flip-or-holdP. A property flip involves an investor purchasing a home, probably making improvements, and then selling for a profit. If you watch HGTV, it is easy to see that people make a great living doing this. Plus, they deliver fantastic work, but there is a dark side to property flips in the eyes of mortgage loans. This is especially true with FHA. Wireless data device modems driver download for windows 10. Property Flip or Hold Pricing Overview. Property Flip or Hold pricing starts at $15.00 per year, per user. They do not have a free version. Property Flip or Hold does not offer a free trial.

So What Approach Should You Take?

For flipping, here is the good and the bad

Good

- Liquid – your money is tied up for less time (hopefully)

- Quick(er) Returns – generally speaking, you will see your profit (or loss) sooner than holding properties

Bad

- A lot of risk (can be minimized some with experience and some luck)

- Capital Gains tax – generally more substantial then the hold approach

Here is the good and bad for the “Holding” approach

Good

- Generally, less up-front work then flipping

- Monthly cash flow (unless you screw up and miss your calculations)

- Appreciation – in most cases, home values increase over time

Bad

- Damage to your properties

- Managing Tenants – use a property manager or property management softwareto reduce this headache

- Potential for long vacancies

Here are some observations you should consider

- Which way is the market heading?

- Can you ride out an extra-long vacancy?

- Do you have enough capital to flip?

- What is the year of the property?

- How will either approach affect your taxes?

- What do you want? Steady cash flow or quicker cash?

We have done both. We have built units and listed them for sale. If they sold, great. If not, they would cash flow nicely. We did our financial calculations for both scenarios so that if the market tanked during construction, they would rent easily. But while the market was hot for sellers, we took advantage of the capital gains.

In either investment approach, it is incumbent on you to buy the property right. Remember the adage, you make your money when you buy, not when you sell. This is true in either situation.

About PropertyZar

PropertyZar is a real estate technology company specifically in the web-based property management software for owners and professional property managers. Read more Top Property Management Blogs. Learn more www.PropertyZar.com.

New Udemy coursehttps://www.udemy.com/property-flip-or-hold

What Will I Learn?

- Evaluate Fix and Flip Profit

- Evaluate Rental Income Profit

- Compare Flip or Hold Property Calculations for Maximum Profit

- Analyze how long it takes to Hold and Rent to make same profit as a Flip

- Make smart purchase decisions to either Flip and take profit now or Hold and Rent for passive income

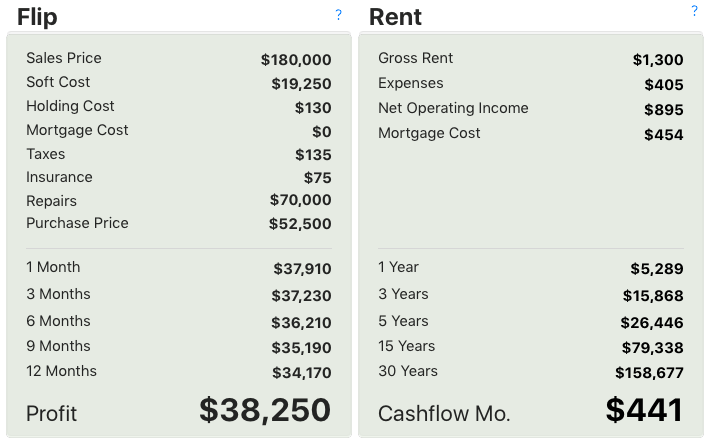

- Single page Flip or Hold Profit comparison

- Create a comprehensive profit comparison report for maximum Return-on-investment

- Calculate After Repair Value

- Calculate Maximum Purchase Price (Best Offer)

Description

This course focuses on the most important aspects of Real Estate Investment, calculations. Yes, Deal Analysis. Numbers do not lie and when trying to make an educated decision at what price a property is worth purchasing and should I Flip or Hold, Real Estate Investing profit evaluation is a must. Teco image driver.

By the end of this course you will be able to calculate your Maximum Purchase Price, Profit at closing when you purchase, Equity, Cash on Cash Return, Calculate scaling profit on your Flip up to 12 months. Calculate Hold and Rent Cashflow up to 30 years. Compare Flip or Hold to how many years it might take to match Profits.

Students will have free access to Property Flip or Hold analysis tools, plain and simple it will do all of the calculations for you. Save multiple Portfolio’s and Properties.

Uses Watchdata card reader driver download.

- Real Estate Investors for personal use or others.

- Flip Property.

- Rent Property.

- Agents for their investors.

Main Analysis

- Value Analysis

- Calculate Maximum Purchase Price based on Profit needed, Soft Cost and Repairs.

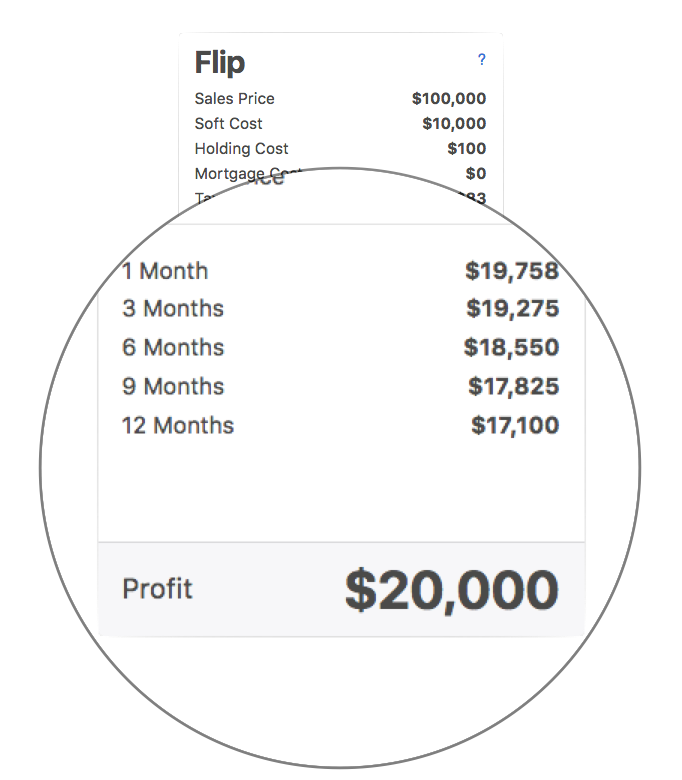

- Flip Analysis for the first 12 months.

- Rent Analysis up to 30 years.

- Rent Analysis shows cumulative Cashflow summary comparing to Flip’s Profit.

- Calculate Mortgage Payment.

- Cash on Cash Return.

- Print individual property Flip or Hold details.

- Save report to PDF and email.

- Real Estate Investing.

Property Flip Or Hold Meaning

Property Evaluation

- Research sold homes in the property area to evaluate ARV.

- Calculate approximate Repair Cost.

- Evaluate Monthly Holding Cost.

- Lookup Property Taxes.

- Estimate Property Insurance.

- Consider evaluation as Cash Offer, Flip and Hold Mortgage.

Real Estate Investing

- No Complex Calculations

- No Long Drawn-out Analysis

- Analyze Flip or Hold Scenarios from one screen.

Property Flip Or Hold Online

Property Flip Or Hold Tv

- Real Estate Investors new or experienced

- Real Estate Investors wanting to quickly compare profit to either Flip or Hold Property

- Agents wanting to send Properties to Real Estate Investors to compare Flip or Hold